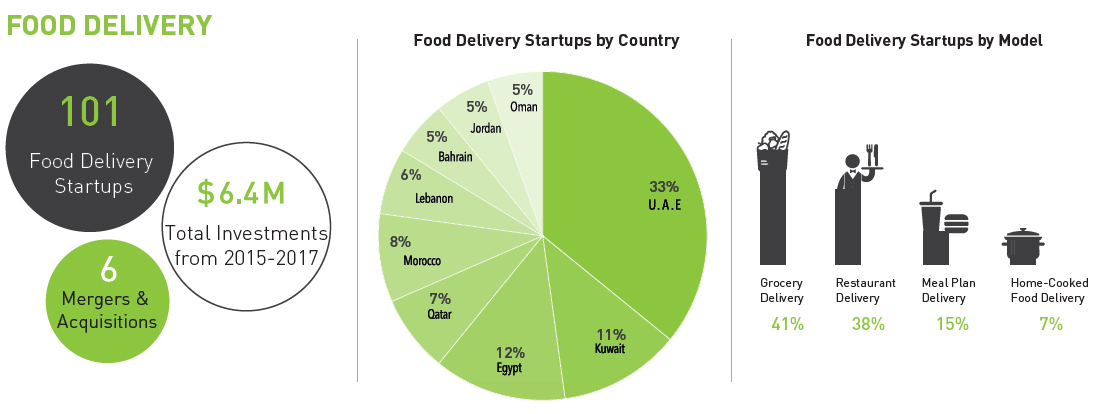

Startups in MENA are tackling food tech categories such as food delivery, restaurant tech, online chef/caterer hire, and food subscription. The following section on food delivery and subsequent installments of this article illustrate the diversity of the food tech categories and business models found within MENA and call attention to some of the most prominent players, key investments, and active markets. The 10 markets that have been included and analyzed are Lebanon, UAE, Saudi Arabia, Bahrain, Jordan, Qatar, Kuwait, Egypt, Morocco, and Oman.

Grocery Delivery

According to Nielsen’s Global E-Commerce and New Retail Survey, one-quarter of global respondents said that they are already ordering grocery products online for home delivery, and more than half said that they are willing to do so in the future. Moreover, the percent of respondents willing to use digital retailing options was highest in developing markets, particularly in MENA (58%).

Among the different food delivery business models, grocery delivery startups are currently the most prominent and popular in MENA, with over 41 unique startups across 10 markets (almost 50% of all food delivery models). The convenience associated with ordering groceries online and having them delivered has led to a surge in grocery e-commerce solutions in the region over the past few years as well as an increase in consumers (particularly millennials) who prefer to do grocery shopping online.

Grocery delivery startups in MENA have also attracted significant funding over the past few years. Leading players GoodSmart (Egypt), Knock Mart (Egypt), Insta Shop (UAE), El Grocer (UAE) and ToDoorstep (KSA) have collectively raised more than $4.4 M in funding since 2015, and UAE-based El Grocer also acquired live ordering platform Quickshop.ae last year as part of its efforts to enhance its services.

Restaurant Delivery

By providing customers with greater choices and convenience and reshaping the restaurant industry, restaurant delivery startups are disrupting the business of food delivery. According to data from CB insights, restaurants using online ordering have seen a 30% increase in revenue, and online food ordering is expected to increase by more than double to 58% over the next three years.

Among the different food delivery models, restaurant delivery is the oldest in the region. Kuwait-based restaurant delivery service Talabat, which was acquired by Rocket Internet in 2015, was founded in 2004 and was the first of its kind in MENA. Today, the region is home to more than 38 unique restaurant delivery startups across 10 different markets, with over 14 startups in the UAE alone.

Although funding in restaurant delivery startups has slowed both globally and in the region, M&A activity among restaurant delivery startups has seen a massive increase. In the past three years, the region has witnessed the acquisition of 6 restaurant delivery startups (24h.ae, Carriage, Talabat, Otlob, ifood.jo, FoodonClick and Hunger Station) by Berlin tech giant Rocket Internet as well as Rocket Internet-backed companies Delivery Hero and Jumia Group.

Prepared-Meal Delivery

Prepared meal delivery startups deliver pre-cooked meals to users, and differ from restaurant delivery startups in that they offer a few daily meal options that are usually prepared at a central kitchen managed by the startups themselves. Inspired by the clean cuisine trend, prepared meal delivery startups are among a new wave of companies that are looking to provide healthier options while remaining convenient and transparent about nutritional values.

While the prepared meal delivery model is still relatively new to MENA, it is gaining traction, and the region is currently home to around 15 unique startups across four markets, with the majority (11) based in the UAE. According to Nielsen’s ‘Global Health & Wellness Survey’, 83% of UAE respondents said that they are willing to pay more for healthy food, thus providing a niche for healthy food startups to flourish and grow.

Home-Cooked Meal Delivery

Home-cooked food delivery startups connect home cooks with working professionals, creating opportunities for people at home to generate income by connecting them to consumers willing to pay for their healthy home-cooked meals. Unlike other food delivery rivals, these startups crowdsource the cooking process, and prioritize the home-cooked quality of food over the convenience of delivery.

While still relatively new to MENA, the home-cooked meal delivery model is catching on, especially in Egypt where 3 of the 6 home-cooked meal delivery startups are based. Cairo-based startup Mumm is currently the leading player in the sector, after having secured a $200K investment from 500 startups, its second round of investment since launching in 2015.

Latest Business

Intelligence Report