A Sneak Peek of Arabnet’s “State of Digital Investments in MENA 2013-2018”

Back

Driven by concerted economic diversification efforts, government development programs, and initiatives to strengthen the entrepreneurial ecosystem and to promote SME activity, the MENA economy continues to grow steadily.

Over the past decade, the venture industry has evolved significantly with funds mainly focused on certain stages. the substantial increase in equity and venture-committed capital has also transformed market conditions, generating more players who seek more opportunities.

With that being said, Arabnet, in partnership with The Mohammed Bin Rashid Establishment for SME Development (Dubai SME), is pleased to announce that it will reveal the fourth edition of the “State of Digital Investments in MENA 2013-2018” during this year’s Arabnet Beirut.

The report investigates the technology investment landscape in the Middle East and North Africa (MENA) region by analyzing investments made by MENA-based investors into MENA-based startups. It aims at informing government leaders, investors, entrepreneurs, and ecosystem stakeholders on the pulse of the region’s startup scene.

In order to do so, data was collected directly from several MENA investors and accelerators. Additionally, information was aggregated from publicly available sources such as Crunchbase, MenaBytes, Wamda, and Magnitt among others. In total, the report analyzes 1,423 equity-based investments from the region.

Key Highlights

-

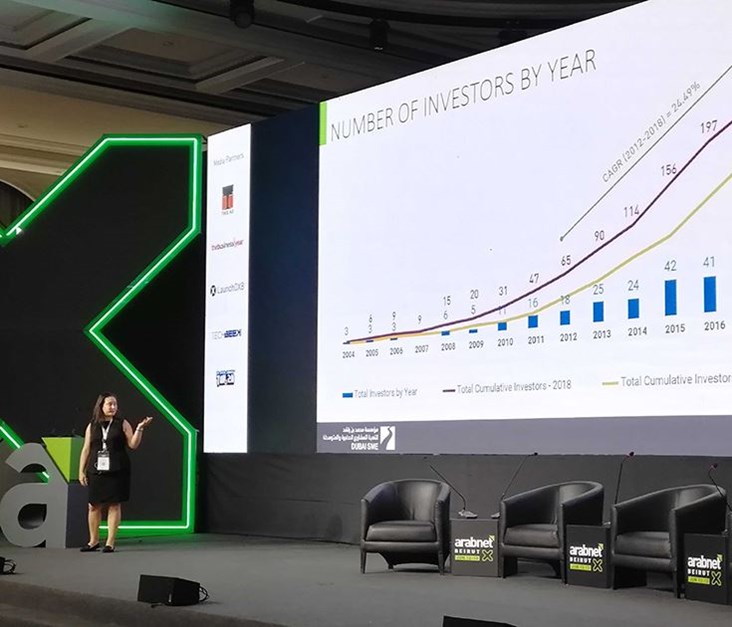

The compound growth rate of tech investors in the MENA region is 25% for the time period between 2012 and 2018, with a 24% increase in funds covered since the 2017 report.

-

Accelerators are at the forefront and represent the largest portion of investors in early stage funds. They are also the fastest growing segment of the investor community over the past five years, displaying a 32% increase from 2013 to 2018.

-

The total number of deals (2013-2018) has grown at a cumulative annual growth rate (CAGR) of 9.5%, while the total value has grown much faster at a CAGR of 23% - signaling a maturing ecosystem where the average value per deal has essentially doubled.

-

The two mega-rounds raised in 2016 by Careem ($350 million) and Souq.com ($275 million) drove total value up, when compared to the considerably smaller deal values of 2017 and 2018.

-

Careem has been the driving force in boosting the UAE’s value of investments over the past three years. The startup captured 40% of all dollars invested in the UAE and 31% of total deal value in the top five markets in 2018 alone.

The report was announced on the 2nd day of Arabnet Beirut X Launchpad forum and it is available to download on our website.

Latest Business

Intelligence Report